ILSOYADVISOR POST

What You Need to Know About Hiring Workers: Calculating a Paycheck

In an earlier blog post, we discussed how to set your business up for payroll. Once your business is setup for payroll, the next step is to figure and write the employee’s paycheck. This blog post will cover pay period options and how to calculate paychecks.

Pay Periods and Gross Wages

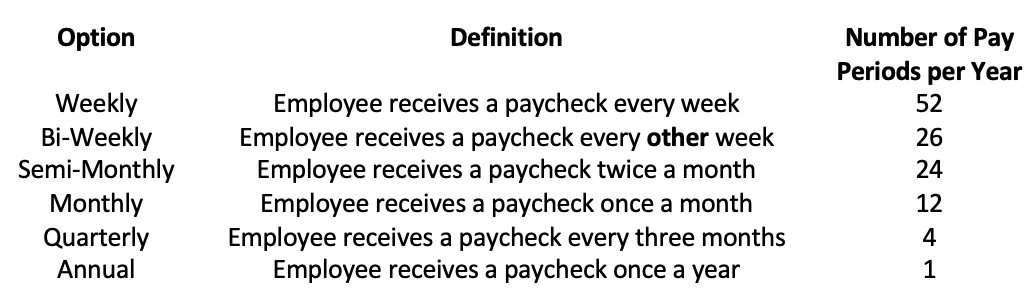

The business will have to decide the frequency of which employees will be paid; Table 1 outlines some of the options, definitions, and number of pay periods per year.

Table 1: Summary of Pay Periods

Once the business has determined the pay period, they need to determine how much each employee will be paid. An employee’s gross wages are the total amount of payment before any deductions from their check (such as withholdings which will be discussed in a later article). It is the starting point for calculating the employee’s net check. There are two ways to pay an employee: salary or hourly. Salary is a based on a fixed amount per pay period. The gross paycheck will be calculated by taking the annualized amount divided by the number of pay periods in a year (listed in Table 1). Hourly is based on a gross rate per hour. The gross paycheck for a given pay period is calculated by taking the number of hours worked times the gross rate. Examples of each calculation can be seen below:

Example 1: An employee has an annual salary of $35,000 and gets paid monthly

Gross Paycheck = $35,000/12 = $2,916.67

Example 2: An hourly employee gets paid $15/hour and worked a total of 40 hours in the current pay period

Gross Paycheck = 40*$15 = $600

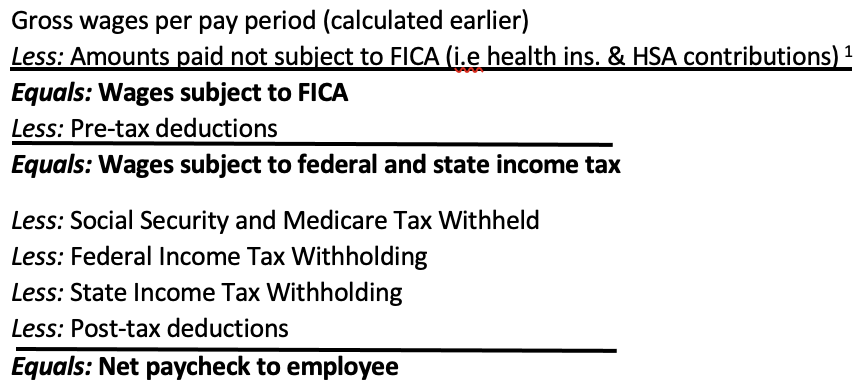

Calculating the Net Paycheck

The formula for calculating the net paycheck can be defined below:

Another method to calculate an employee’s wages is to “Gross Up”. In this method, the employer pays both halves of an employee’s Social Security and Medicare tax. The paycheck is written without having the FICA tax withheld and the amount due for FICA tax is calculated when payroll deposits and reporting are required. The employer will then deposit both halves for the employee. A later blog post will discuss how to calculate Social Security and Medicare (FICA), Federal, and State tax to withhold for both methods.

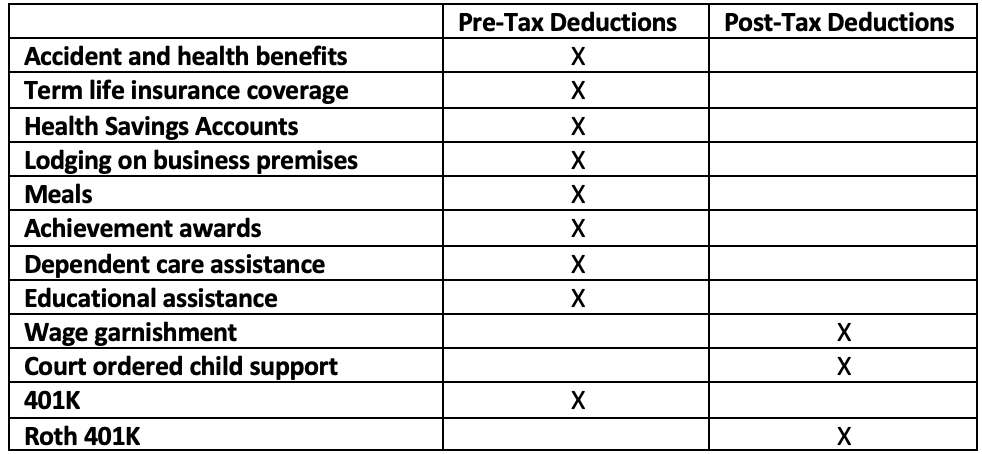

Pre- vs. Post-Tax Deductions

The difference between pre- and post-tax deductions is the timing of the calculations for FICA, Federal, and State withholdings. As the name suggests, a pre-tax deduction is one that is taken out before the withholding amount is calculated from the employee’s gross paycheck. This means, the employee has not paid tax on that income. Most of the time, this occurs because the income is not subject to one or more of FICA, Federal, or State tax or because the employee is able to defer paying the tax until a later time (Employer Retirement Plan). Different than pre-tax, a post-tax deduction is one that is deducted from the paycheck after taxes have been calculated. This means that tax has already been paid on the income. Table 2 shows examples of different pre- and post-tax deductions.

Table 2: Summary of Pre- and Post-Tax Deductions

It’s important to note that for most agriculture employees, a large majority of these will not apply. However, it’s necessary to be aware of the differences if they were to ever be applicable.

Unemployment Taxes

Generally, agricultural labor is exempt from federal and state unemployment taxes. However, Federal Unemployment Tax (FUTA) is assessed on your agriculture business if:

- 10 or more workers in any portion of 20 different weeks in a calendar year are employed, and/or

- Total payroll is $20,000 or more in taxable cash wages in any calendar quarter

All non-agriculture labor is required to pay FUTA tax with limited exceptions. The FUTA tax rate is 0.6% on the first $7,000 wages paid to EACH employee. A Federal Form 940 must be filed annually for any business that is required to pay FUTA tax. Illinois Unemployment Tax (SUTA) is required on the first $12,740 of wages paid to each employee. The tax rate is assigned to each business by the Illinois Department of Revenue; these deposits must be made quarterly with the UI-340, Employer’s Contribution and Wage Report.

Conclusion

This is the second blog post in a series covering different topics regarding payroll. These are general guidelines and information, it’s always important to consult with an accounting or tax professional to ensure that the complete steps for your situation are taken. Stay tuned for the next post in the series “What You Need to Know about Hiring Workers: Calculating Withholdings.”

[1] FICA is the “Federal Insurance Contributions Act” and is comprised of the Social Security and Medicare tax.

Comments

Add new comment