ILSOYADVISOR POST

Deciphering Types of Income

Introduction

It’s that time of year again…tax time. Many farmers have already filed March 1, others will file by May 17 (the normal filing date of April 15 was recently pushed back by the Internal Revenue Service). Whether you’ve already filed, reviewing your return or have yet to receive all your tax documents, there are often many questions as to which income items are taxable and how they are taxed. This blog post is going to review some unique income items for 2020, different types of income and how they are taxed. We will start by discussing three of the most common income categories (ordinary, capital gain, and self-employment) and finish by reviewing unique 2020 income items.

Ordinary Income

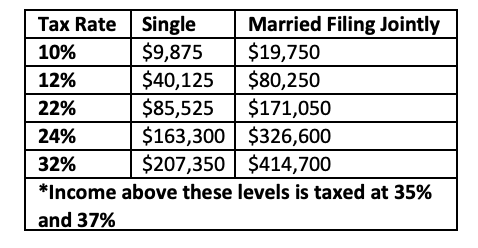

As the name would suggest, ordinary income is the most common. Most taxpayers’ income is taxed as ordinary income tax rates. Some examples of ordinary income are: wages, rental income, interest, and retirement income. Cash rent, crop share, and most passthrough income from an entity (trust, or S Corporation), are also considered ordinary income items. Another common type of income generated from farming businesses are machinery and breeding livestock sold. Any depreciated portion of machinery and purchased breeding stock sold are taxed as ordinary income. Table 1 outlines the top of each tax bracket for different income levels.

Table 1: 2020 Tax Rates and Brackets

Capital Gain Income

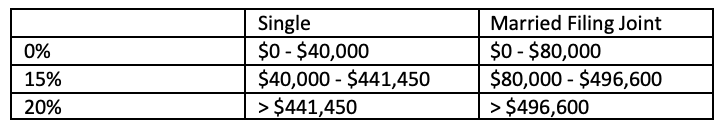

When a capital asset is sold, capital gain tax is imposed on the income. The most common types of capital assets are stocks or bonds held for investment, land, and second homes. These are considered short-term capital assets if they are held less than one year and long-term capital assets if they are held longer than one year. Gain is realized to the extent the sale price exceeds the adjusted basis in the asset. Gain from the sale of short-term capital assets is taxed at ordinary rates; the gain from long-term capital assets is taxed at either 0, 15, or 20 percent depending on the income level; Table 2 outlines the capital gain tax brackets. Raised breeding livestock sold is considered long-term capital gain income if they are held for more than 12 months (24 months for cattle and horses).

Table 2: 2020 Long Term Capital Gains Tax Rates and Brackets

Self-Employment Income

Self-employment tax is imposed on taxpayers who operate a business as a sole proprietor, independent contractor, or general partner. Self-employed individuals will either file Schedule C or Schedule F. Common types of income reported on a Schedule C would be income from a seed business, trucking, construction or a hair salon. Products raised (grain and market livestock), USDA payments, crop insurance, rebates/refunds, and custom hire income are all reported on the Schedule F for farmers. Both Schedule C and F filers are considered self-employment income. The self-employment income tax rate consists of the Federal Insurance Contributions Act (FICA) tax; 12.4 percent for Social Security and 2.9 percent for Medicare, for a total rate of 15.3 percent. Since self-employed individuals are responsible for the full amount of the FICA tax (as opposed to a W2 employee whose employer pays half of the tax on their behalf), there are several additional deductions available. Self-employed individuals may be able to deduct half of their total self-employment tax, health insurance premiums paid out of pocket, and certain retirement plan contributions as an adjustment to income.

Unique 2020 Income Items

Coronavirus relief, USDA payments, and Syngenta settlement payments are just a few of the unique tax pieces that 2020 provided. Some taxpayers received an Economic Impact Payment (EIP), more commonly referred to as, stimulus payment. The first round of these payments were made in the spring of 2020 ($1,200 per taxpayer and $600 per dependent under the age of 17). The second round occurred at the end of 2020 ($600 per taxpayer and $600 per dependent under the age of 17). While these payments are not taxable income, it’s important to ensure that your tax professional knows the amount you and your household received through the EIP for the first and second round. The Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL) were two widely used relief programs for self-employed individuals and businesses with employees. Both the PPP loan proceeds and EIDL are non-taxable. CFAP 1 and CFAP 2 were programs through the USDA to assist producers with market disruptions due to the coronavirus pandemic, these were reported to producers on a 1099 issued by the Farm Service Agency and should be included in your Schedule F income. Many producers received payments from the Syngenta settlement in 2020 and they should be included in your Schedule F gross income.

Conclusion

It’s important to consider the type of income you receive and what tax implications you will incur as a result of your business and investment ventures. Please consult your tax professional to ensure you are appropriately reporting your unique 2020 income items.

Comments

Add new comment