As our farm businesses use tax planning tactics to reduce current tax liability impacts, we do not completely reduce the tax but move the tax to a future year. This webinar will provide details on the importance of identifying and calculating your operation’s deferred tax liability and how that can affect your current and future strategic farm management decisions.

Presenter: Dick Wittman, Wittman Consulting, Farm Manager/Family Business... Read More →

ILSOYADVISOR POST

Depreciation: Starting with the Basics

December 08, 2020

Depreciation is a term you’ve probably heard your accountant use fairly often; understanding its full meaning and financial implications is important to make strategic management decisions. The concept of depreciation is not as daunting as one would think. This article will provide details to give you more confidence when discussing and selecting depreciation for your operation.

An Example – Tractor Purchase

When you purchase a tractor (or other depreciable property), it starts to lose value as it ages. When the tractor is sold, it likely brings less in return than the original purchase price. Depreciation is a way to capture a tax benefit for the loss in value by allowing a deductible business expense over the life of the asset. This can be handled through a variety of methods, depending on the tax situation and result you want to achieve.

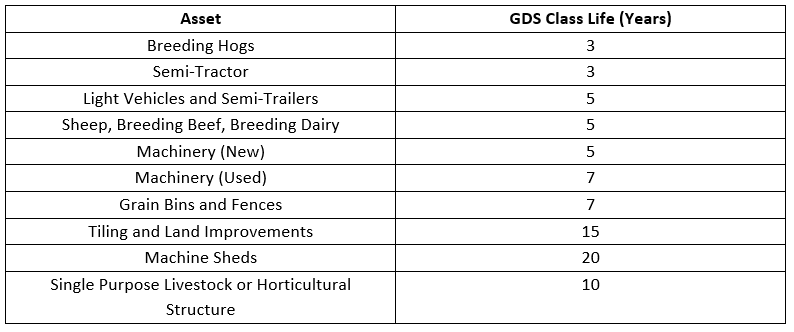

Class Life

When depreciating an asset, the first step is to determine its class life (useful life of an asset). The IRS determines the class life for each category of depreciable assets. The depreciation expense is then spread over the appropriate period of years. Table 1 below shows common farm assets and class lives under current tax law.

Table 1: Common Farm Assets and Class Life

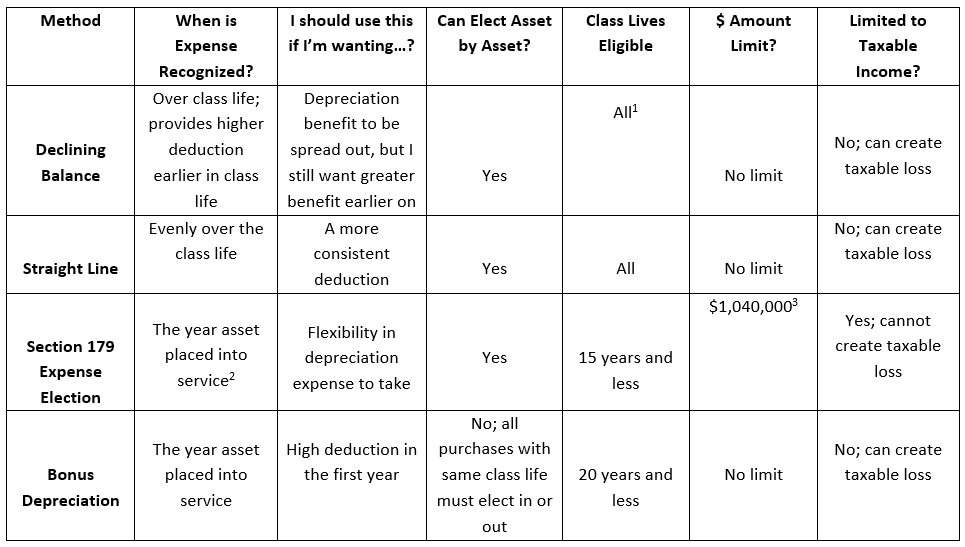

Common Depreciation Methods

Some of the most common depreciation methods in agriculture include: Declining Balance, Straight Line, Section 179 (Expense Election) and Bonus Depreciation. Table 2 below summarizes these depreciation methods. Since this is not an all-inclusive list, please consult with your tax preparer to refine your depreciation plan.

Table 2: Summary of Depreciation Methods (IRS)

CAUTION: Businesses should be cautious when using Section 179 or Bonus Depreciation, as the depreciation deduction is not spread over the life of the asset. This is particularly important if the asset is purchased with financing. In subsequent years, businesses continue to make a non-deductible principal payment with less depreciation available to offset income. That could result in the operator making loan payments along with higher tax liability in the same year, which can strain cash flow.

Depreciation Recapture

What’s the catch to the depreciation expense previously discussed? Since the business receives a tax benefit of depreciation expense, the depreciation taken will create taxable income when the asset is sold. Basis is the remaining amount of your investment in an asset; when an asset is purchased, your basis is the original purchase price. As depreciation is taken, basis in the asset diminishes. Knowing your basis in the asset is key to determine how much of the sale price will be included as taxable income. For example, if someone buys a tractor for $100,000, their initial basis is $100,000. Each year, the basis decreases by the amount of depreciation taken on that asset. If the tractor is sold for $75,000 and $40,000 of depreciation had been taken up to that point, the remaining basis is $60,000 (100,000-40,000). Since the tractor was sold for more than the basis, the farm has taxable income of $15,000 (75,000-60,000) from the sale, which is referred to as depreciation recapture. This recapture of depreciation is taxed at ordinary tax rates.

Conclusion

As illustrated above, depreciation is a powerful tool and plays a role in shaping your bottom line. While it can quickly become a complex topic, business owners do not need to learn the exact specifications of each depreciation method. A basic conceptual understanding can aid immensely in producing a more strategic depreciation approach for your business.

References

1 Depreciation formula is based on years in class life

2 Section 179 allows a taxpayer to take any dollar amount for depreciation up to the eligible dollar amount for Section 179 assets placed in service in a given year. The remaining expense is spread over the life of the asset.

3 Reduced if total purchases over $2,590,000

2 Section 179 allows a taxpayer to take any dollar amount for depreciation up to the eligible dollar amount for Section 179 assets placed in service in a given year. The remaining expense is spread over the life of the asset.

3 Reduced if total purchases over $2,590,000

Comments

Add new comment