ILSOYADVISOR POST

Working Capital to Value of Farm Production - One Measure of Liquidity

This article was originally published on the farmdoc daily website.

This article examines working capital to value of farm production for selected producer characteristics. Working capital to Value of Farm production is one of the traditional measures of liquidity suggested by the Farm Financial Standards Council (FFSC), with others being current ratio and working capital. Overall, working capital to value of farm production has declined since 2013.

Background

The Financial Guidelines for Agriculture developed by the Farm Financial Standards Council (FFSC) identified five general financial measures when evaluating the financial performance of the farm firm. These include liquidity, solvency, profitability, repayment capacity and financial efficiency. Different financial measures were identified and defined for each general group. There are three measures listed for measuring liquidity: current ratio, working capital and working capital/gross revenues ratio. Financial analysis by some groups substitute value of farm production (VFP) for gross farm revenue. The FFSC recognizes both methods of calculation in their guidelines.

Using Illinois Farm Business Farm Management (FBFM) Association data, this article examines working capital to value of farm production for selected producer characteristics. While the traditional measures of a farm’s liquidity, the current ratio and working capital, are common measures historically used, the measurement of working capital to value of farm production also takes into consideration a farm’s size. Obviously, a larger farm needs more working capital than a smaller farm to have the same level of liquidity. In addition, the higher this figure, the better, that is stronger liquidity.

Working Capital to VFP by Farm Type

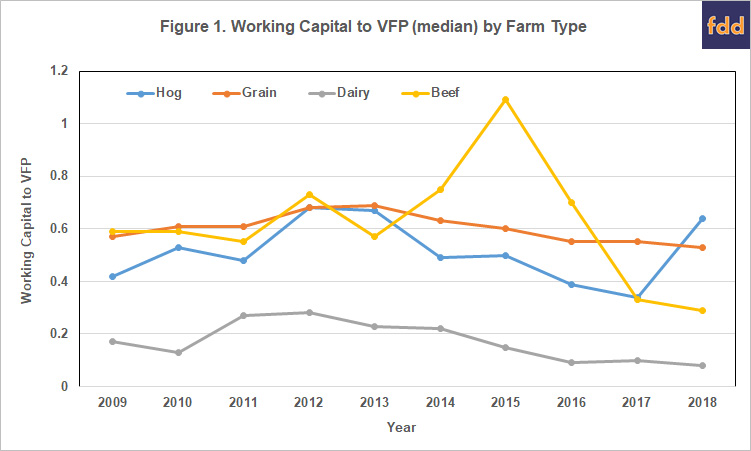

Figure 1 charts the median (50 percent of the farms above and below this figure) measurement of working capital to value of farm production by farm type. The four farm types are hog, grain, dairy and beef farms based on FBFM’s definition of these farms. Grain farms are defined as farms where the value of feed fed was less than 40 percent of the crop returns. Hog, beef and dairy farms are defined as farms where the value of feed fed was more than 40 percent of crop returns and the livestock enterprise (hog, dairy or beef) received the majority of the value of feed fed.

Generally, working capital to VFP has declined since 2013 for most farm types. The 2012-13 period was the end of the era of high grain prices. Since then, we have seen financial deterioration in most farms as farm incomes have declined.

Continue reading the full article on farmdoc daily.

Lattz, D. and B. Zwilling. "Working Capital to Value of Farm Production – One Measure of Liquidity." farmdoc daily (10):9, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 17, 2020.

Comments

Add new comment